Press Release

Centris Residential Sales Statistics – July 2025

Montreal Census Metropolitan Area (CMA)

- Good July for the Montreal CMA residential market, with sales growing by 10 per cent compared to the same period in 2024.

- Increased activity observed in all large geographic sectors in July, the most significant taking place in Vaudreuil-Soulanges which jumped by 29 per cent, while the South Shore saw the most modest growth at just 2 per cent.

- The number of active listings saw little year-over-year change (+2 per cent) with market conditions continuing to clearly favour sellers throughout the Montreal CMA—a trend consistent across all geographic sectors.

- Property prices continue to show robust growth compared to the same period last year, although moderating slightly in recent months. Compared to July 2024, the median price for a single-family home in the Montreal area rose 7 per cent to $625,000.

- The year-over-year change in median prices was also positive in July for condominiums (+3 per cent) and for 2-5 unit plexes (+8 per cent).

L’Île-des-Sœurs, August 7, 2025 – The Quebec Professional Association of Real Estate Brokers (QPAREB) has just released its residential real estate market statistics for the month of July 2025. The most recent market statistics for the Montreal Census Metropolitan Area (CMA) are based on the real estate brokers’ Centris provincial database.

In July, 3,731 residential sales were recorded in the Montreal CMA, an increase of 10 per cent compared to the same month in 2024. This was the highest level of transactional activity since the 2021 peak during the pandemic. “When compared to the same month last year, price increases appear to be easing in the Montreal CMA. The 7 per cent growth in the single-family home median price in July shows a shift away from the 10 per cent pace observed in early 2025,” explains Hélène Bégin, Senior Economist, Quebec Economy and Real Estate Market, QPAREB Market Analysis Department.

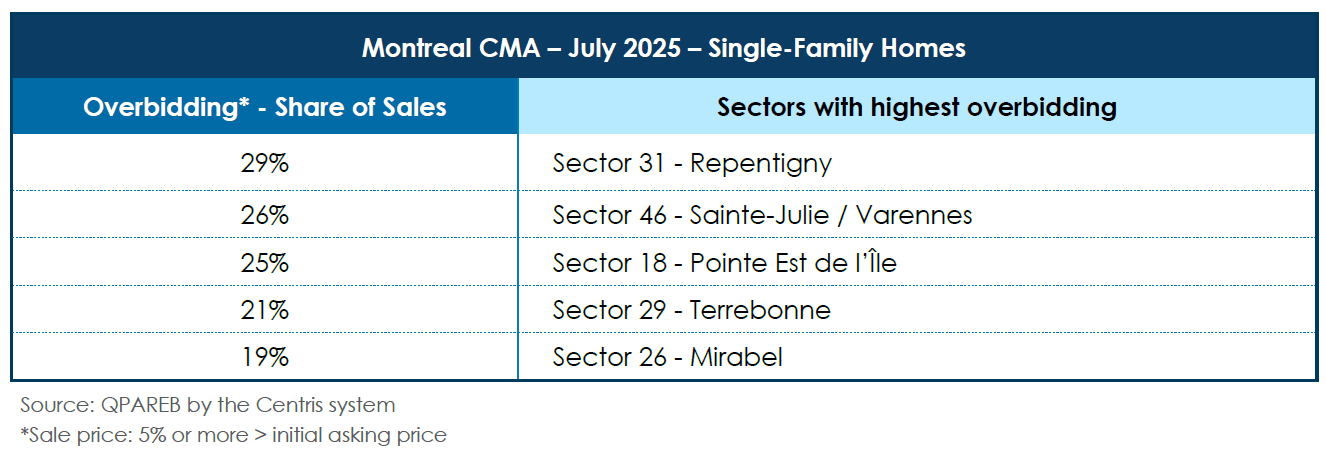

Two trends were evident in July: prices continued to rise and overbidding remained present, although far from widespread, in the Montreal CMA. It should be noted that two conditions must be met for a sale to be considered overbidding, according to the QPAREB. First, the transaction must be concluded after multiple promises to purchase have been submitted for the same property within a short period, and second, the final price must be at least 5 per cent higher than the listing price when the property is put on the market. Simply selling a property higher than the initial listing price does not qualify as overbidding, as negotiations can lead to added inclusions that justify a higher price—such as major appliances, a spa, or a winter carport.

In July 2025, only 11 per cent of sellers obtained a price at least 5 per cent higher than the original listing price, which is similar to the share of overbid sales a year ago in the Greater Montreal area.

“Despite the volatility in the economy, Montreal’s real estate market experienced a very active month of July and stands out positively compared to certain Canadian markets—particularly Vancouver and Toronto—where sales and prices dropped in early spring due to disruptions caused by the first wave of U.S. tariff hikes,” notes Hélène Bégin.

The supply of properties for sale in these two markets has increased rapidly, while demand has weakened due to the climate of uncertainty. Although there appears to be a recent upturn in their activity, these metropolitan areas are generally more vulnerable than Montreal to a deterioration in the economic environment. Montreal’s economy has, however, also lost steam since the spring. The unemployment rate rose from 6.5 per cent at the beginning of the year to 7.0 per cent in June.

Relatively lower property prices in Quebec’s largest city explain its higher level of affordability, especially when compared to smaller cities such as Calgary and Ottawa, according to the residential real estate market indicator by CMA from the economists at the National Bank. That being said, Canada’s major markets have never been this unaffordable when considering household incomes, property prices, and mortgage interest rates.

The decline in variable mortgage rates has come to an end in recent months due to the rebound in core inflation across the country, leading the Bank of Canada (BoC) to hold the key interest rate steady at its last three decisions. The future movement of variable mortgage rates will depend on upcoming changes to the BoC’s policy rate, since this rate serves as the benchmark for variable rates. On the other hand, fixed mortgage rates are influenced by fluctuations in bond interest rates, which in turn depend on investor sentiment in financial markets. Investors are increasingly concerned about the rise in core inflation, which is approaching 3 per cent in both Canada and the United States, and putting upward pressure on 3- and 5-year mortgage interest rates.

Additional information:

Detailed and Cumulative Monthly Statistics for the Province and Regions

If you would like additional information from the Market Analysis Department, such as specific data or regional details on the real estate market, please write to us.

About the Quebec Professional Association of Real Estate Brokers

The Quebec Professional Association of Real Estate Brokers (QPAREB) is a non-profit association that brings together more than 15,000 real estate brokers and agencies. It is responsible for promoting and defending their interests while taking into account the issues facing the profession and the various professional and regional realities of its members. The QPAREB is also a major player in many real estate dossiers, including the implementation of measures that promote homeownership. The Association reports on Quebec’s residential real estate market statistics, provides training, tools and services relating to real estate, and facilitates the collection, dissemination and exchange of information. The QPAREB has its head office in Quebec City, administrative offices in Montreal and regional offices in Saguenay and Rouyn-Noranda. It has two subsidiaries: Société Centris inc. and the Collège de l’immobilier du Québec. Follow its activities at qpareb.ca or via its social media pages: Facebook, LinkedIn, X, and Instagram.

For more information:

Ariane Boulé

Morin Relations Publiques

Image bank (credit QPAREB) available free of charge.